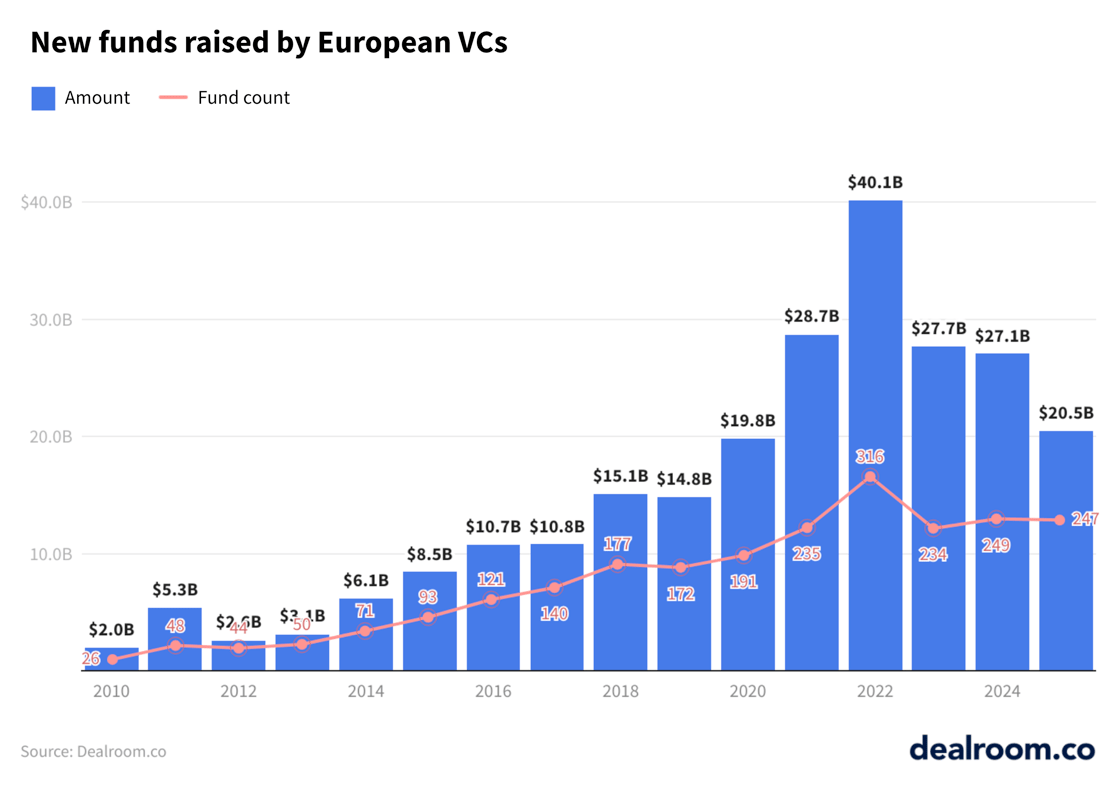

For much of 2025, the narrative around European venture capital fundraising was bleak. But according to Dealroom, European venture capitalists raised $20.5bn across 247 new funds in 2025. That’s down from the $27.1bn raised in 2024, but hardly a freefall.

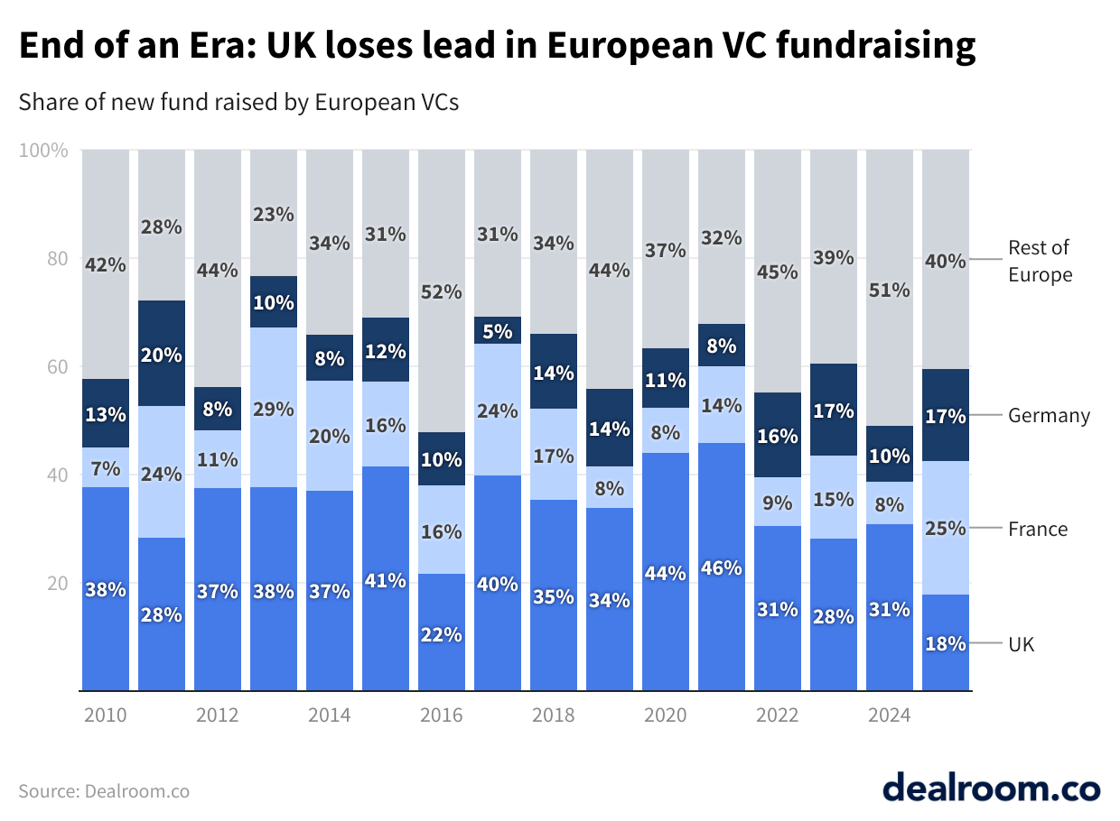

The headline story, however, is that for the first time in recent memory, France overtook the UK in VC fundraising.

French venture capital firms raised $5.1bn in new funds in 2025. UK VCs, by contrast, raised just $3.7bn, a 56% drop year-on-year. The result is a symbolic and structural shift: the UK accounted for just 18% of European VC fundraising in 2025, well below its historic 30–40% share, and even lower than during the Brexit vote year of 2016.

For more than a decade, London has been Europe’s default venture capital hub, hoovering up capital, talent, and international LP attention. But the data shows that dominance cracking. Fewer large UK funds reached first close in 2025, and those that did tended to be smaller.

Let's take a closer look at the top three markets:

France

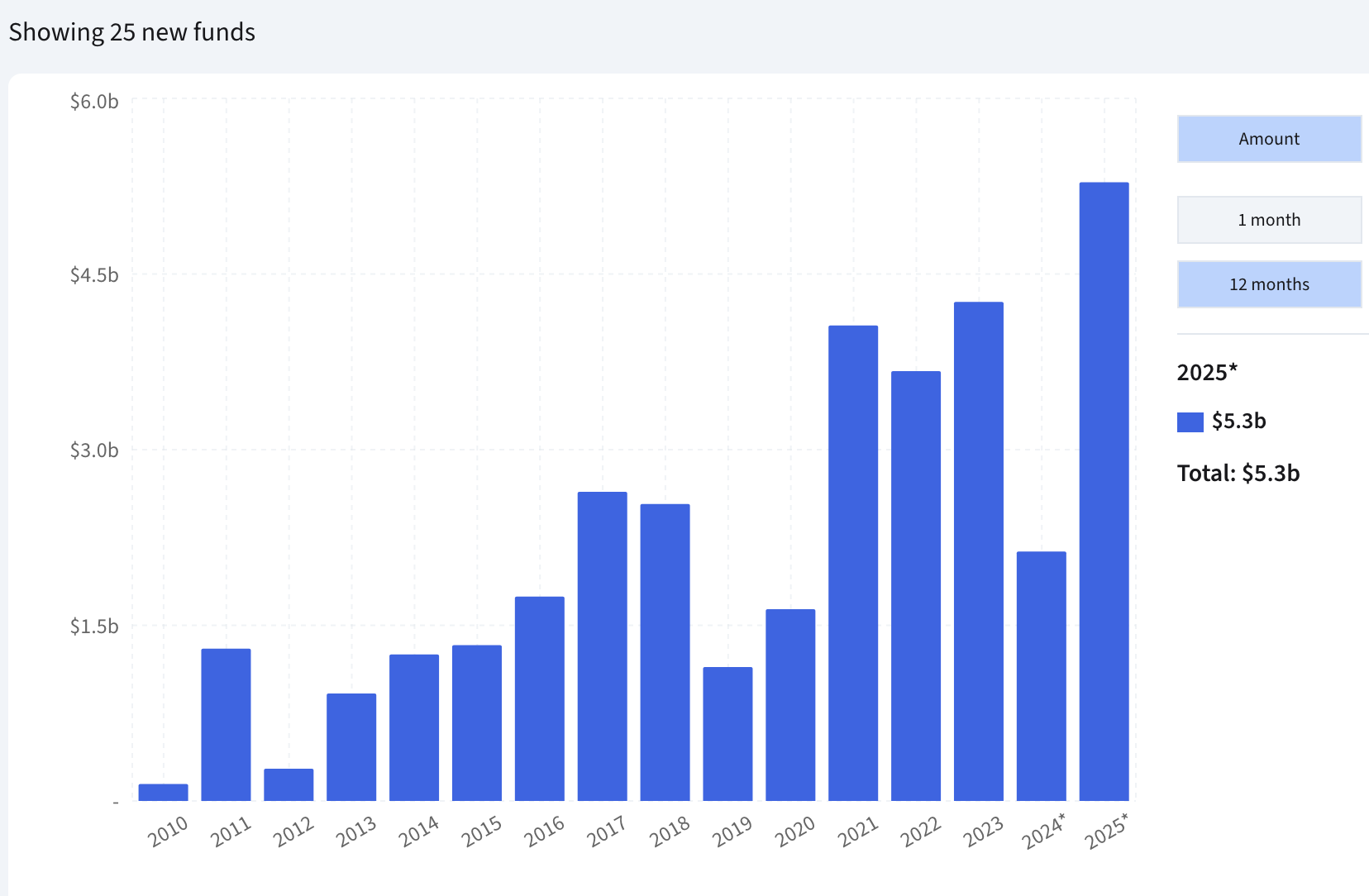

Some of this dynamic simply comes down to timing: Who is raising and closing when.

To that end, two of the biggest funds announced in Europe were in France: Cathay Capital (€1.0bn) and Sofinnova Partners (€1.2bn). That was followed by Jolt Capital ($600m) and Revaia ($200m).

But there were also 25 new funds closed overall, and that reflects another historic factor in France: the role of national innovation bank Bpifrance. Among the many roles it plays, Bpifrance is also one of Europe's most active LPs, with the primary focus, of course, on France.

I wrote a deeper dive on Bpifrance's LP activity for Sifted two years ago:

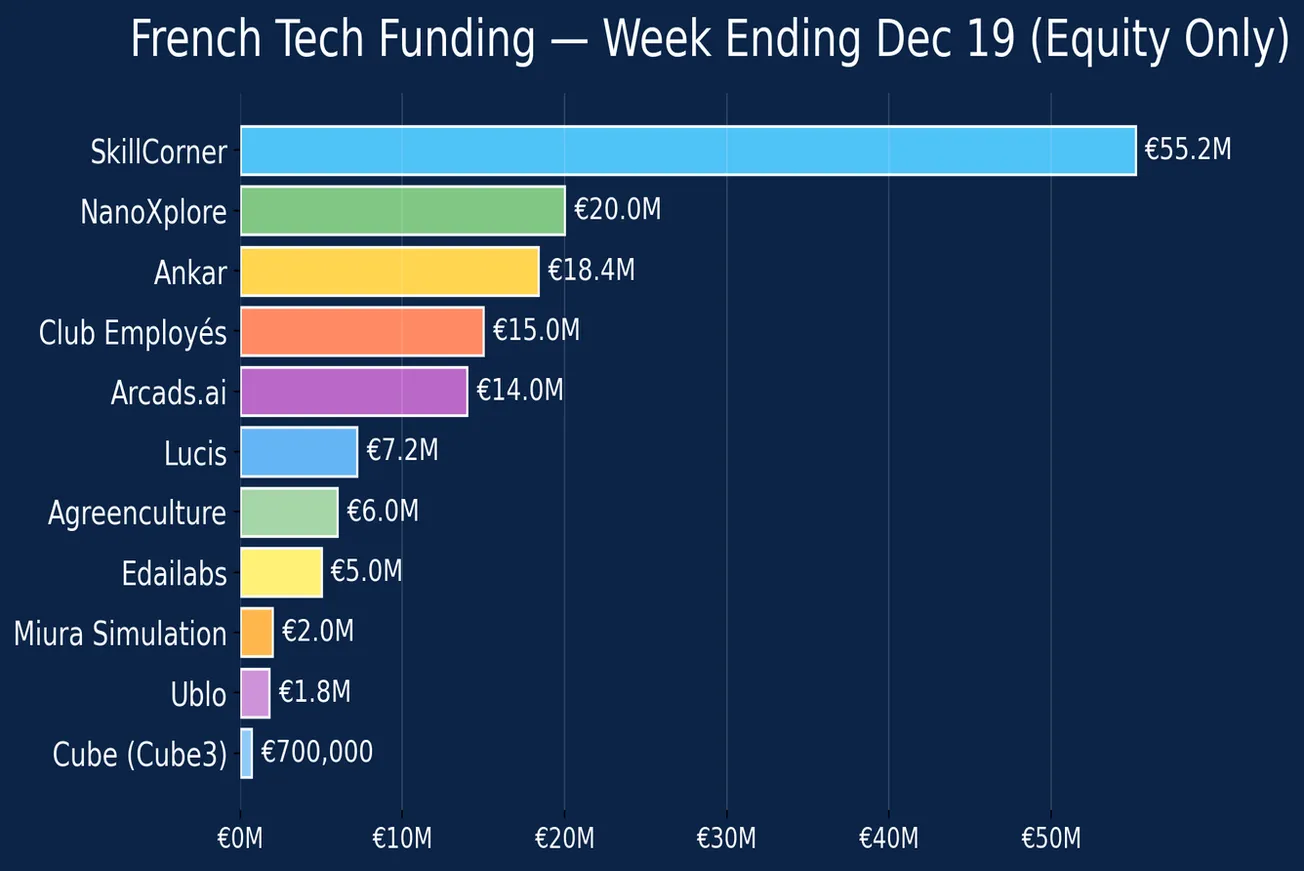

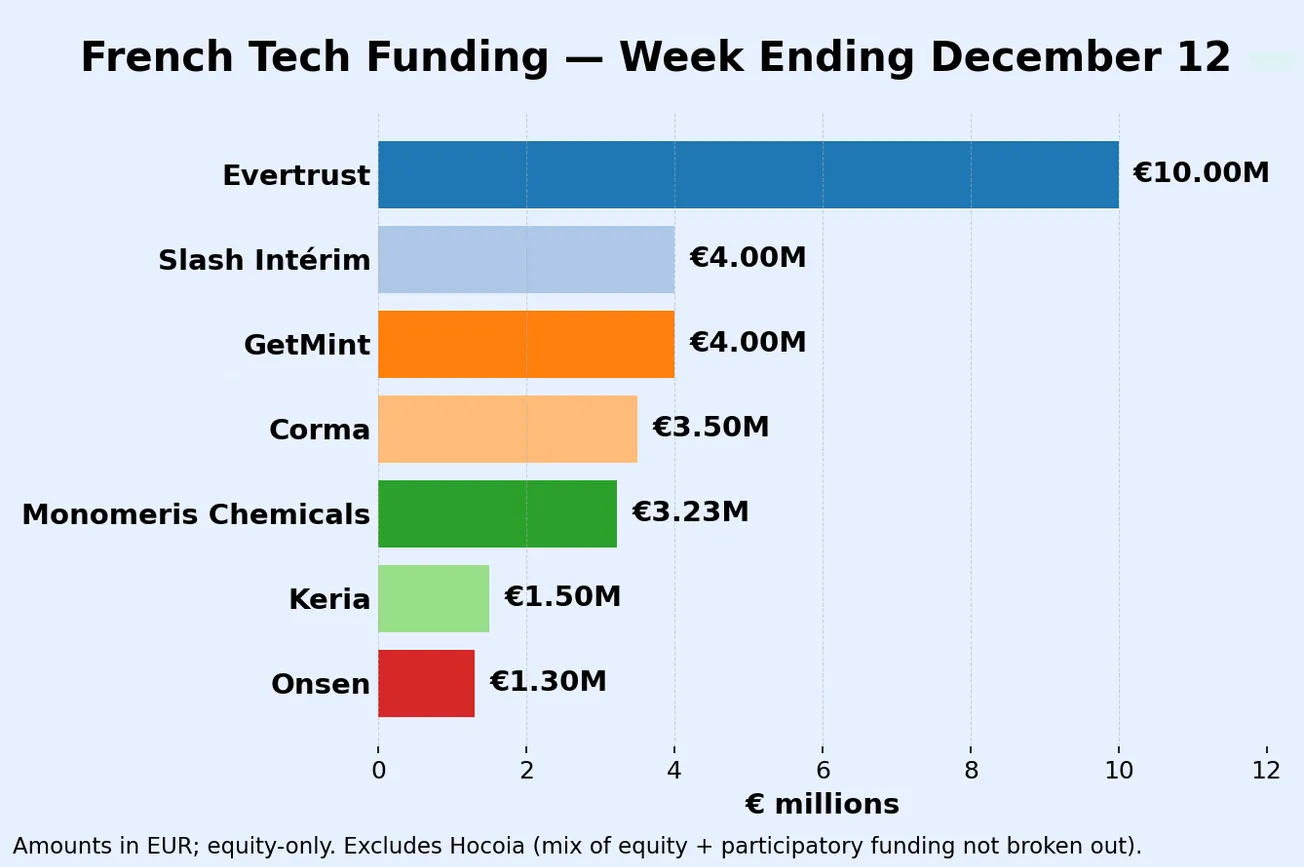

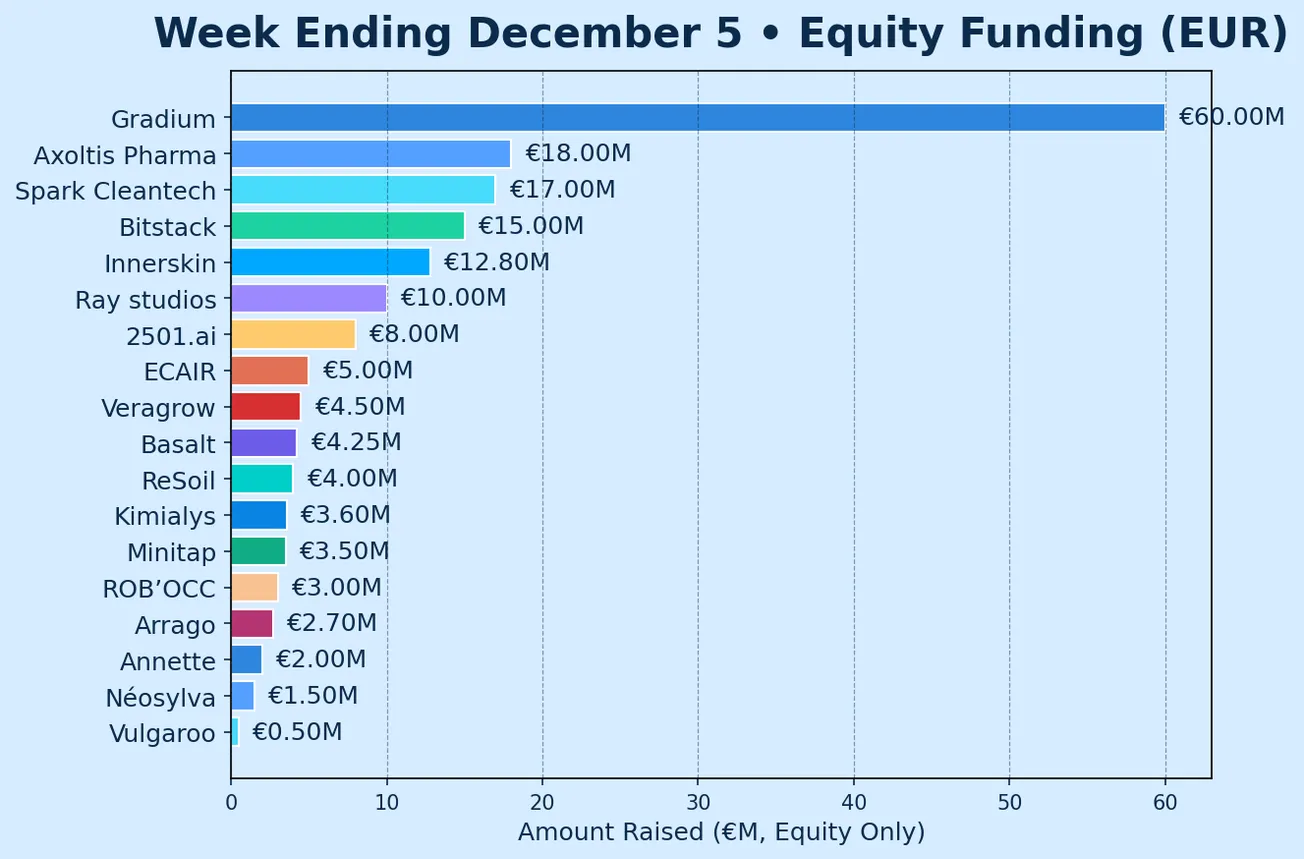

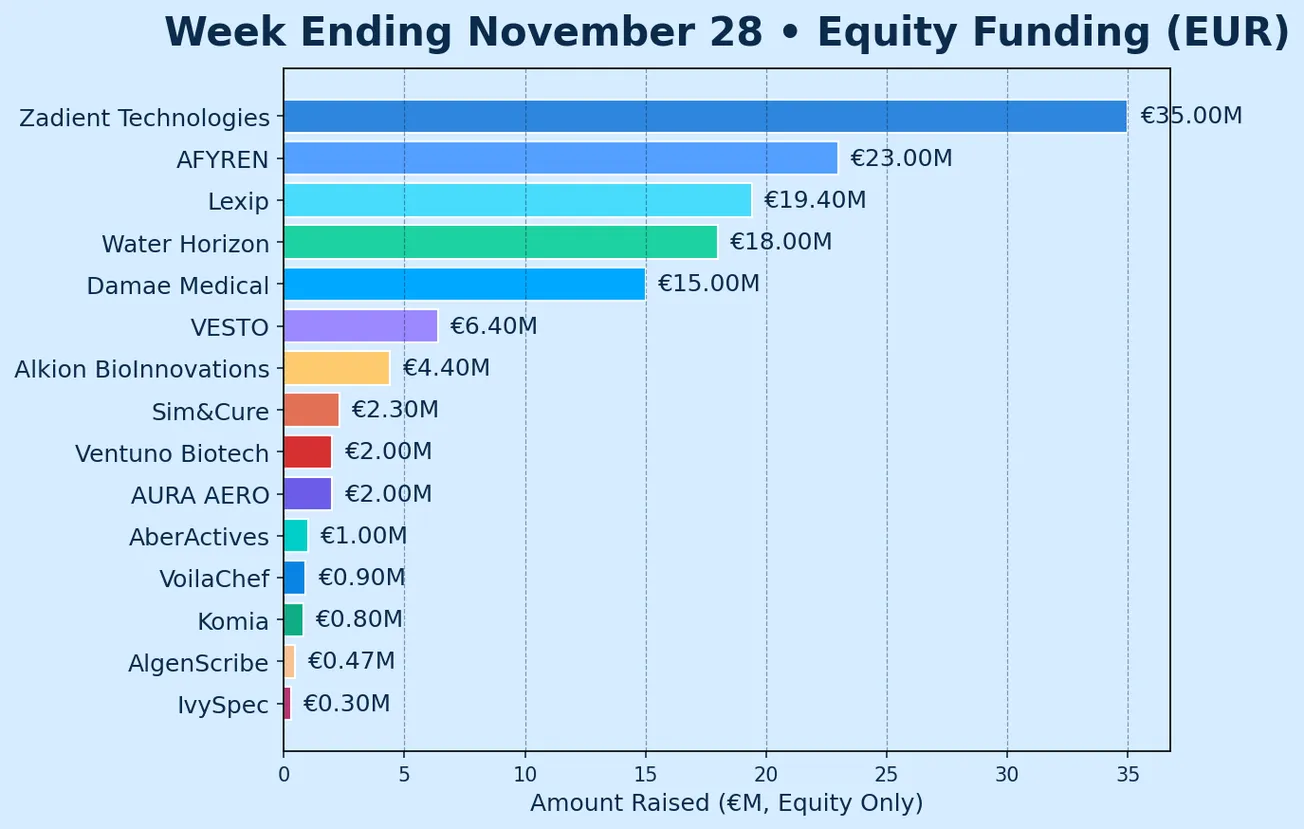

The top funds closed in 2025 included:

UK

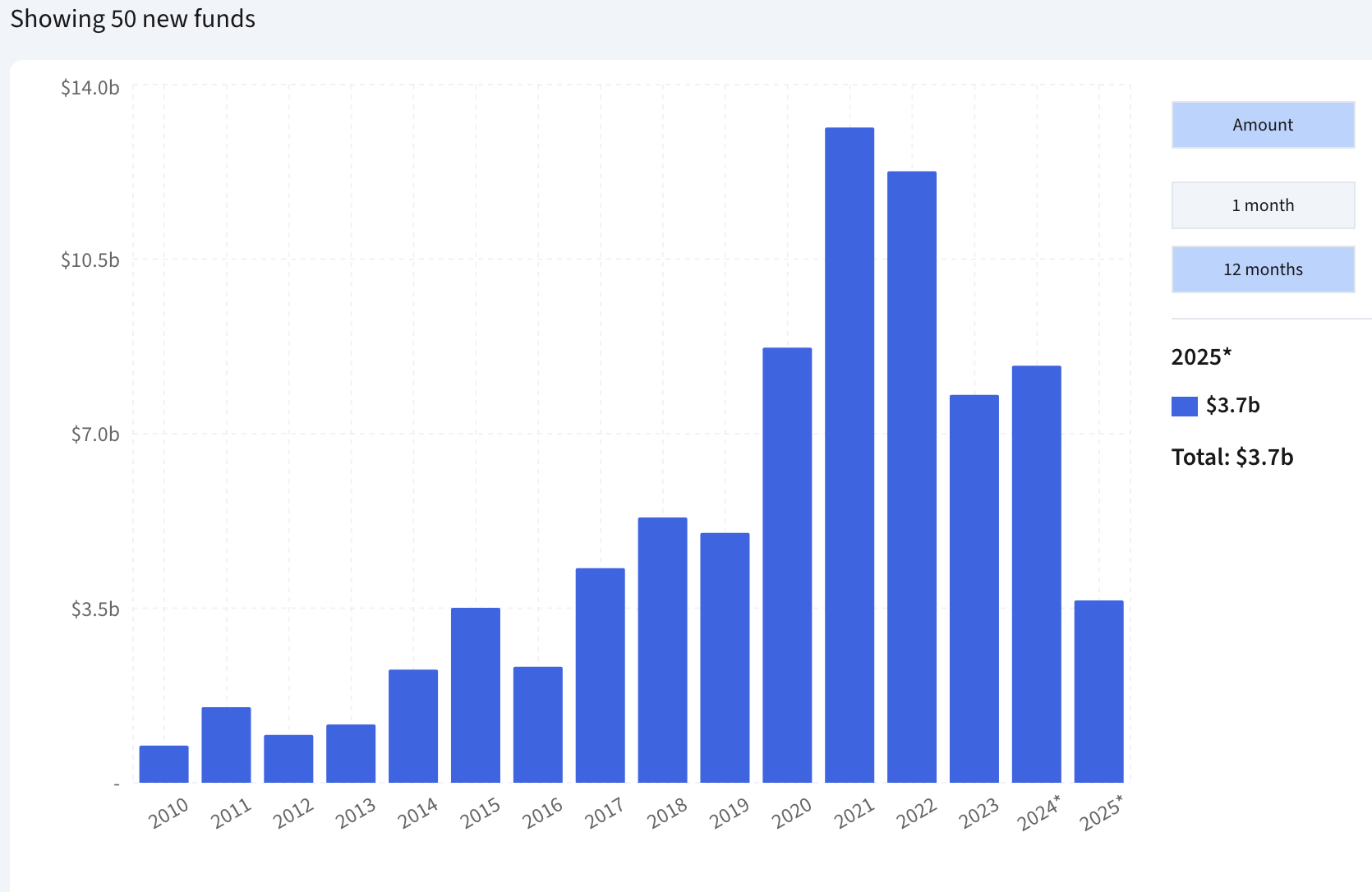

The UK chart in Dealroom’s report shows a clear flattening after the 2021–2022 peak. The UK had more new funds, but the biggest ones were not as big as the top ones in France.

Germany

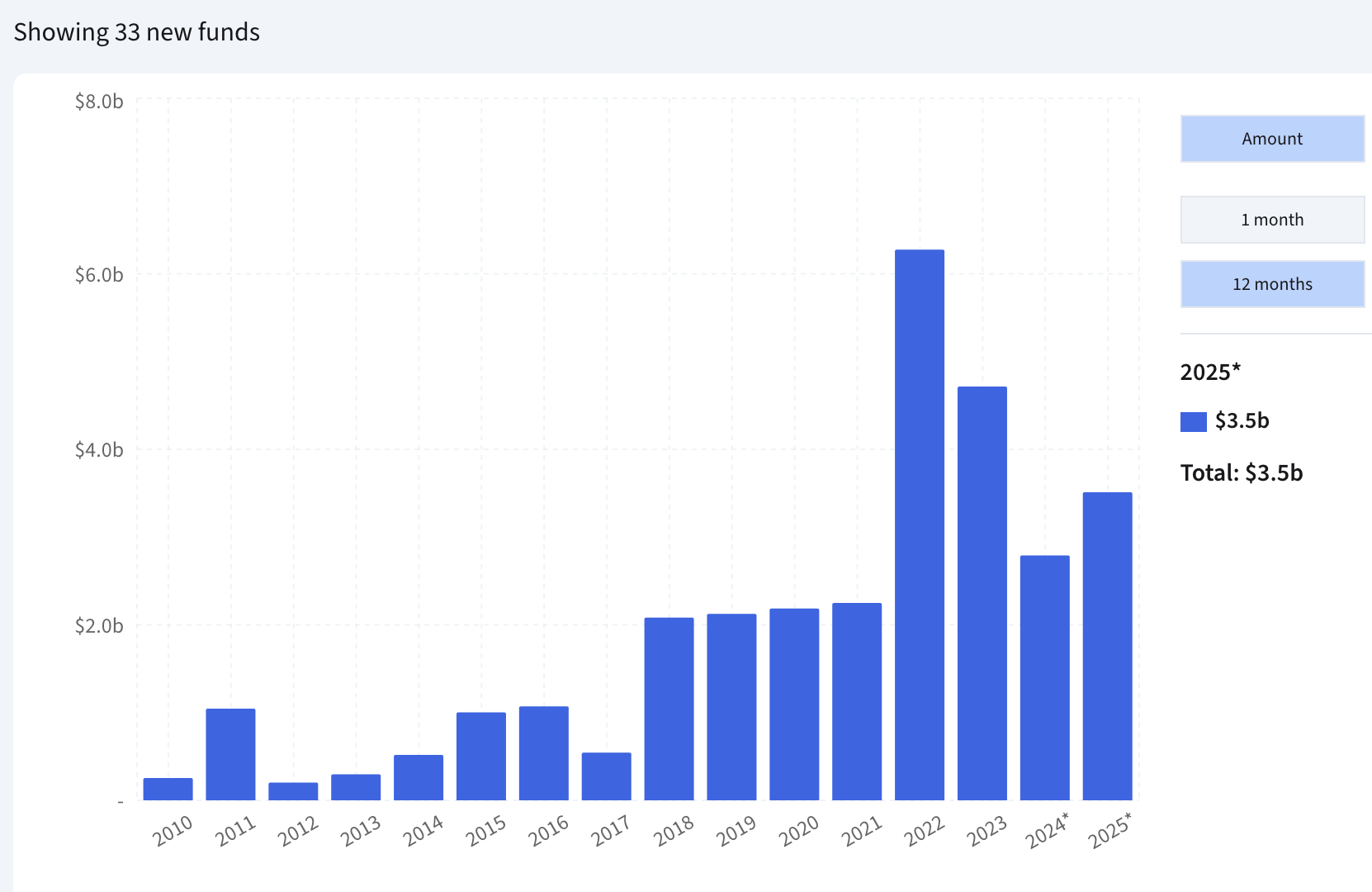

Germany sits somewhere in between. German VCs raised around $3.5bn in 2025, according to Dealroom, up from 2024. Berlin remains strong in early-stage and operationally focused funds, but Germany lacks the breakout momentum France is currently enjoying — and avoided the sharp contraction seen in the UK.

The top new funds in Germany in 2025: